No law firm likes receiving a negligence claim. By their very nature, negligent acts lack malice or intent, so a negligence claim can feel overwhelming particularly as our working lives are made more complex by emerging threats, like cyber-attacks, or external stressors. So, what are the main negligence claims facing law firms today? What can you do to avoid them?

We spoke to Lawcover’s Legal Risk Manager Glenda Carry about the practice areas most impacted by negligence claims, what behaviours can lead to adverse claims by clients, and what risk mitigation strategies law practices can put in place.

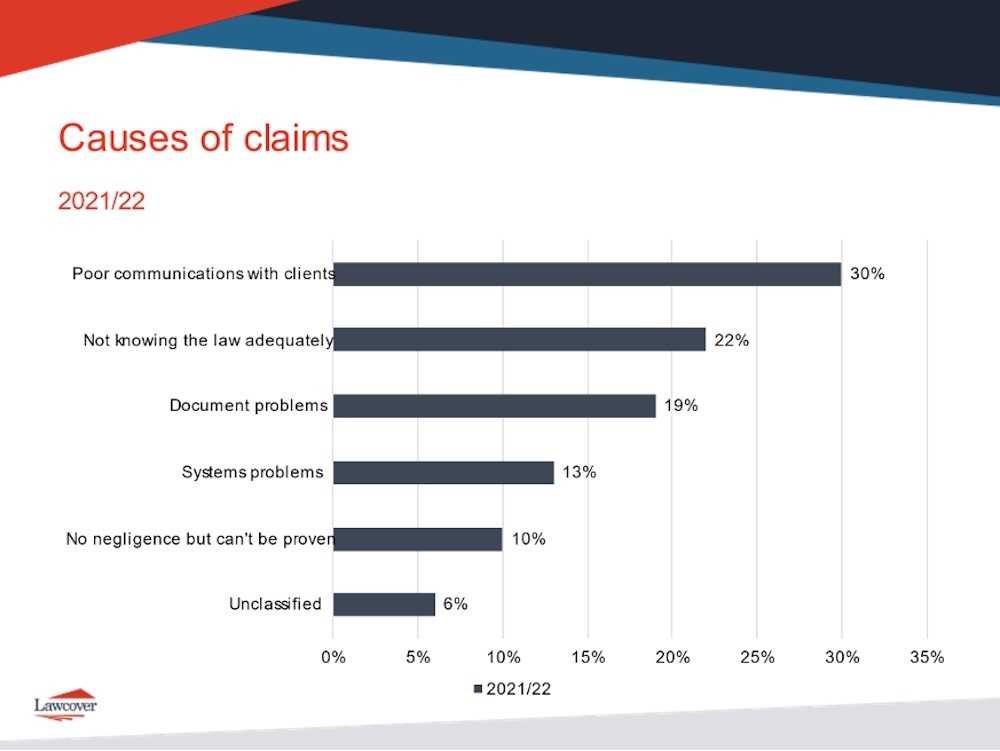

You may be surprised but 30% of all claims across 2021 and 2022 were driven by poor communication with clients and 22% driven by not knowing the law adequately. Read on for some eye-opening facts!

The leading causes include cyber-attacks and surcharge purchaser duty errors

As solicitors shift to emails and online operations to run their firms more efficiently, organised cybercrime has followed, exploiting human error inherent in the life of any busy professional. There are clear trends emerging.

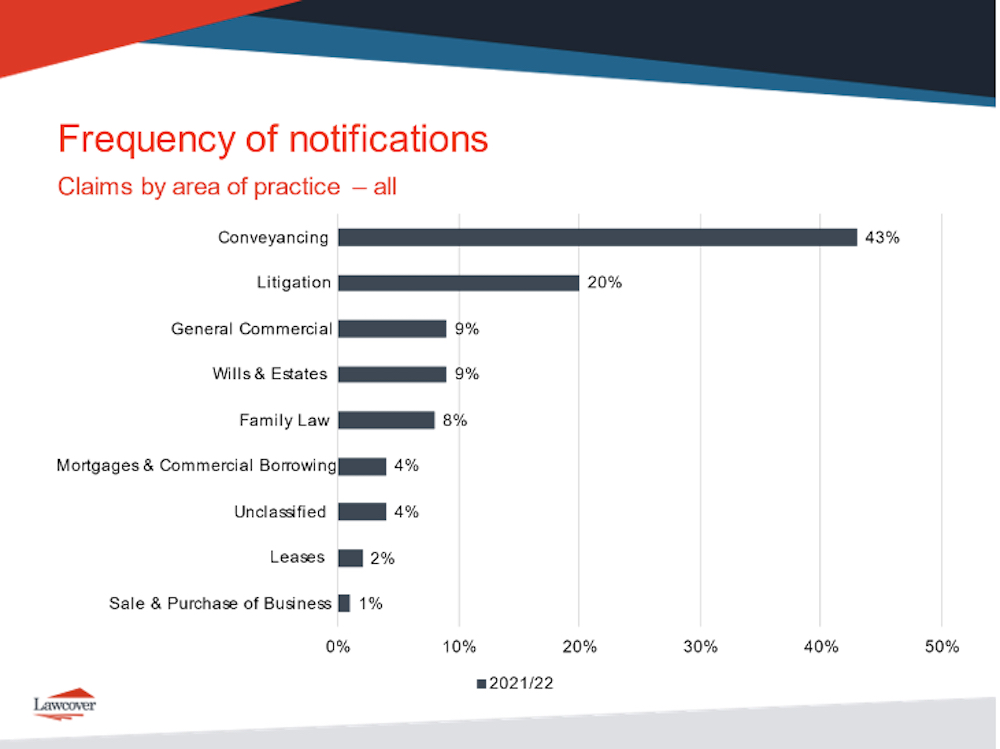

“The biggest shift has been the uptick in claims arising from surcharge purchaser duty errors, picked up in audits by Revenue NSW, and cyber-attacks on law practices, predominantly conveyancing practices,” Glenda says. “For the year that ended on 30 June 2022, 30% of property law notifications related to surcharge purchaser duty. Looking at the most recent annual statistics, we see that conveyancing/property law gives rise to the highest number of notifications at 43%.”

The 2020/21 financial year marked Lawcover’s biggest year for cyber claims to date, in terms of monies paid out, though Glenda warns that the 2022/23 could hit a new high.

“It’s impossible to say with certainty that the pandemic, and the rapid shift to working from home that accompanied it, caused this uptick,” Glenda explains. “It is possible this trend would have emerged anyway, as more solicitors transitioned towards electronic communication systems and email.”

According to Glenda, most cyber-attacks come from insecure use of email - in fact, this form of cyber-attack is known as ‘business email compromise’ (BEC).

“This is why a major focus for Lawcover has and continues to be sourcing and providing practical cyber resources for law practices.”

The practice areas and firms most at risk

Conveyancing, litigation, commercial law, wills & estates and family law - areas of law predominantly practised by local, smaller firms - are most at risk of a negligence claim. This is reflected in Graph 1.1 below.

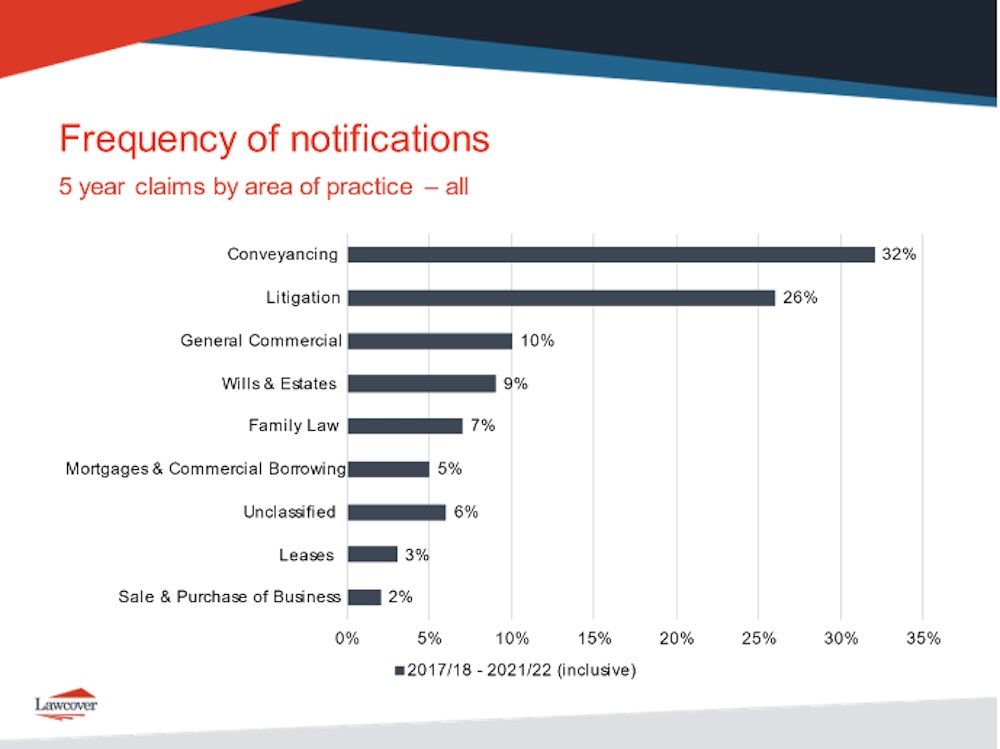

“As you can see in Graph 1.2, although conveyancing remained highly represented over the past 5 years, in more recent years, negligence claims made against conveyancing solicitors have continued to increase significantly. This is due to an increase in claims arising from cyber-attacks and the application of surcharge purchaser duty.”

“Other areas of law remain consistent, with notifications in litigation trending downwards,” Glenda says. “The good news is that we’ve seen a slight decrease in the number of notifications generally. A total of 703 notifications were received in the year to 30 June 2022, compared with 766 in the year to 30 June 2021.”

Graph 1.1: This reflects the frequency of claims notifications to Lawcover, by practice area.

Graph 1.2: This reflects the frequency of claims notifications to Lawcover, by practice area, over the past 5 years.

Why do conveyancing and litigation lead the charge when it comes to negligence claims?

Conveyancing

The majority of conveyancing claims relate to issues arising from surcharge purchaser duty and cybersecurity. But as Glenda explains, the complex and fast-paced nature of conveyancing means it can arise from other areas of practice, including:

- Failure to advise or providing incomplete advice to purchasers, concerning restrictions on development/use, easements, contamination, contract terms, duty payable or concessions available.

- Vendor issues, which often relate to a failure to correctly deal with the GST/Margin Scheme, failure to attach the prescribed documents to a contract for sale or poor drafting of or omission of special conditions.

- Issues arising from ineffective exercise of an option.

- Issues regarding intra-family transfers, and potential conflicts of interest.

“Conveyancing is high-volume and often perceived by clients as a straight-forward exercise,” Glenda says. “However, Lawcover’s statistics paint a very different picture. Conveyancing is a highly competitive market with a lot of players. This can lead to price pressure which can in turn lead to a business model where more experienced practitioners delegate the work to less experienced employees, sometimes without adequate supervision. Price pressure can also lead to cutting corners, which can be dangerous in a field subject to regular legislative change.”

Litigation

While negligence claims have trended downward in recent years, litigation remains a deadline-driven area of law, and without effective management of critical dates things can be missed. Investing in a systematic approach to manage litigation dates and deadlines can pay dividends. Another key strategy is to enlist workflows which facilitate transparent communication with clients. Emails can be confusing to follow.

According to Glenda, a significant factor contributing to claims in litigation is missed limitation dates and out of time applications. Other notable areas include:

- Failure to advise or providing incorrect advice surrounding appropriate jurisdiction, appeal rights and alternative remedies.

- Failure to manage litigation appropriately. This can involve a failure to comply with court directions on time, or failure to progress a client’s matter, which may result in a personal costs order against the solicitor.

- Settlement regret, whereby a client may feel dissatisfied with an outcome. Managing client expectations is often one of the trickiest, but most important aspects of litigation.

“Litigation practice is often a high-pressure environment where effective diary management and effective communication skills are crucial,” Glenda says. “In litigation, as in many other areas of practice, it is not uncommon for failure to supervise to be a contributing factor to the claim.”

Poor communication main cause for claims

Given the stress and complexity involved in the law, it’s no surprise that poor communication is a leading cause of claims against law practices. Emails are simply not designed to facilitate the effective exchange of information; they are intended to notify, not communicate. Phone calls take time to schedule. New platforms, which allow clients to view the progress of their case and communicate in real time with their lawyers, take time to explore.

“We’ve consistently seen ‘poor communication’ flagged as the main cause of negligence claims, followed by ‘not knowing the law adequately’,” Glenda says.

The law is often said to be a moveable feast and it can be hard to keep up with key changes.

“In more recent years, this second category has been driven by the surcharge purchaser duty claims which impact conveyancing practices,” Glenda explains.

“When we drill into the more granular data, we see that failure to communicate often relates to allegations of failure to advise, or incomplete explanation and/or advice.”

Where the solicitors’ version of events differs from what the client alleges, it can be difficult for courts to ascertain the truth. This is why Lawcover recommends that all legal advice is confirmed in writing.

“At the very least, it should be documented in a contemporaneous file note. The file note should include the nature of the advice given, and the initiatives taken to confirm client understanding of that advice. Producing a contemporaneous file note when allegations of ‘failure to advise’ arise, often results in an early resolution of a claim,” Glenda says.

“Failure to detail or confirm the retainer in writing is another cause of miscommunication. The retainer should clearly scope what the agreed work will include. In other words, it should detail what the law practice has agreed - and perhaps not agreed - to do. A retainer is not necessarily the same as a cost agreement or cost disclosure, though many solicitors use a single document to deal with both.”

Graph 1.3 This reflects the causes of claims notifications to Lawcover

So, how do you minimise your risk of a client alleging ‘poor communication’?

According to Glenda it all starts with understanding your client’s objectives. Asking what does success look like for my client? This helps you manage expectations, which is key to good client communication.

“Dropping legal jargon and using plain English wherever possible can also assist, as well as asking open-ended questions. This can help you ascertain whether the client understands the transaction,” Glenda explains. “This also helps to ensure you are obtaining informed instructions. This is especially important where you are acting for a vulnerable client, and/or dealing with an improvident transaction.

“For example, this could involve a vulnerable client mortgaging their family home to assist a family member to obtain a business loan. When these transactions don’t go well for the vulnerable client, usually a parent or grandparent, this can result in a cross claim against the solicitor. Whilst solicitors are not authorised or insured to give financial advice, your assessment of the client's understanding of the transaction can be greatly assisted if you ask the right questions.”

The law is a language unto itself, and for clients whom English is also new, this can be a significant challenge.

“Where English is not your client’s first language – insist on an independent qualified interpreter and not a family member,” Glenda says.

One of the key mitigators of risk is simple. You need to implement sound practice management systems. This means investigating effective practice management systems, stress-testing and involving staff in their implementation.

“Lawcover has a suite of ‘Law Practice Checklists’ which may assist with developing these systems, from client onboarding through to matter management and file closing,” Glenda says. “However, any system is only as good as those operating it, so it is imperative that staff are trained on use of the systems, and random checks carried out to ensure compliance.”

For more information on practical business management skills and strategies review the College’s Legal Practice Management course and our Legal Business Management qualifications. Learn from leaders in the industry.

![How to handle Direct Speech after Gan v Xie [2023] NSWCA 163](https://images4.cmp.optimizely.com/assets/Lawyer+Up+direct+speech+in+drafting+NSW+legislation+OCT232.jpg/Zz1hNDU4YzQyMjQzNzkxMWVmYjFlNGY2ODk3ZWMxNzE0Mw==)